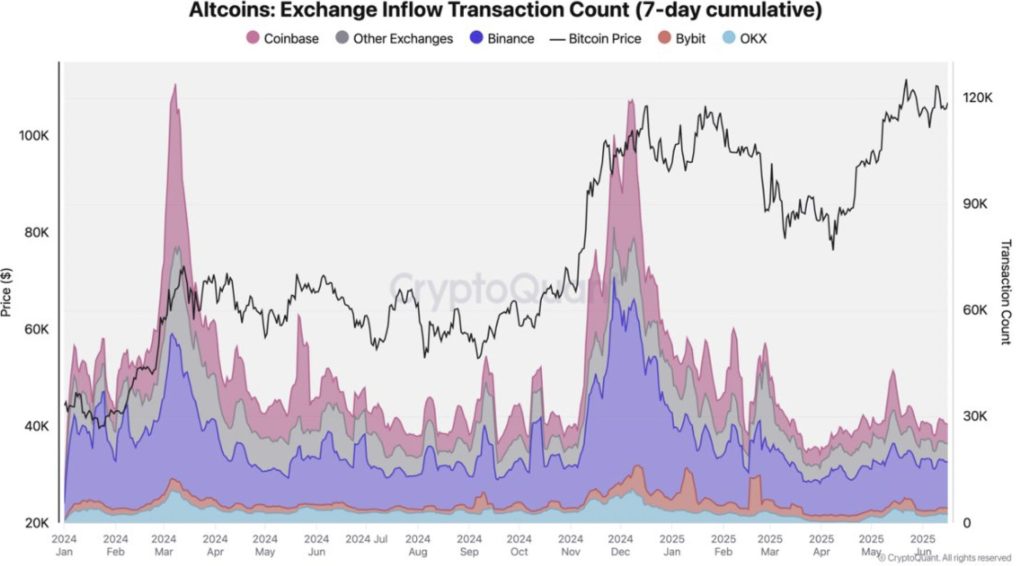

Binance continues to assert itself as the top exchange for altcoin trading, leading the market in altcoin deposit activity, according to a new report from on-chain analytics firm CryptoQuant.

At the peak of last year’s November-to-December altcoin rally, Binance handled as many as 59,000 deposits in a single day—more than double Coinbase’s roughly 26,000 and far above the 24,000 total going to all other exchanges combined.

Even in calmer market conditions, Binance maintains its lead, averaging approximately 13,000 altcoin inflow transactions per day. In contrast, Coinbase averages 6,000, and other platforms average around 10,000.

Altcoin inflows typically increase in the wake of strong market rallies, suggesting traders are moving assets onto exchanges to lock in profits. These spikes often coincide with local price peaks and increased speculative activity, reports CryptoQuant.

Binance’s sustained inflow dominance is due to its broad altcoin offerings and deep liquidity, making it the preferred destination for both retail and institutional traders during periods of heightened market momentum.

Stablecoin Activity on Ethereum Favors Binance

Binance also holds a commanding position in stablecoin inflows on the Ethereum network, particularly in transactions involving USDT and USDC, reports CryptoQuant.

Over a recently observed period, Binance received around 53,000 Ethereum-based stablecoin transactions, compared to 42,000 for Coinbase, 28,000 for Bybit, and just 11,000 for OKX. This trend demonstrates Binance’s status as the primary entry point for dollar-denominated capital entering the crypto market via Ethereum.

Stablecoin inflows are often seen as a precursor to increased trading activity, as they represent capital being parked on exchanges for potential deployment.

Binance’s dominance in this segment indicates strong trader and investor confidence, further reinforcing its position as the go-to platform for liquidity and execution.

TRON Network Data Further Confirms Binance’s Edge

The trend extends to the TRON network, where Binance consistently receives the highest volume of USDT deposits. In the past seven days alone, Binance registered approximately 384,000 USDT inflow transactions, outpacing Bybit with 321,000 and HTX with 163,000.

With its low fees and quick transaction times, TRON has become the go-to rail for moving stablecoins. Most of that traffic ends up at Binance, showing just how firmly the exchange has positioned itself in stablecoin trading.

CryptoQuant notes that exchanges with dominant stablecoin inflows are often positioned to benefit from increased trading volume and user trust.

Binance’s consistent lead across both Ethereum and TRON networks confirms its central role in global crypto liquidity and capital allocation.

Trending News

RecommendedPopular Crypto TopicsPrice Predictions

Be the first to comment